Glamping Market Size, Trends, and Business Outlook For 2023

But if you’re a vacation rental property manager, it can feel overwhelming and complicated to consider how to transfer your existing skills to glamping.

You’re likely wondering whether it’s worth investing in the trend, the glamping market size, who your customers might be, and what they expect. And how can you use tech to stand out from the competition, in an environment where there may be limited signal or Wi-Fi?

We get that you want to ensure your guests have just as positive of an experience under a canvas or hut as they would under a traditional roof.

That’s why in this post we’ve compiled the latest industry analysis and research to give you a powerful snapshot into the glamping market. Insights include:

- How glamping is a growing trend worldwide

- The key demographics of the market

- The must-know emerging trends

- The market’s main challenges and market players

- Specific trends for North America (US and Canada)

- Tips on the technology that glamping vacation rentals need to stay efficient and connected, even in remote, off-beat locations.

Glamping is growing – make sure your rental tech can keep up

Glamping market report: An overview

Overall, if you’re wondering whether now would be a good time to diversify into glamping, then wonder no longer. The answer is a resounding “yes.” (For more tips, check out our guide all about how to start a glamping business.)

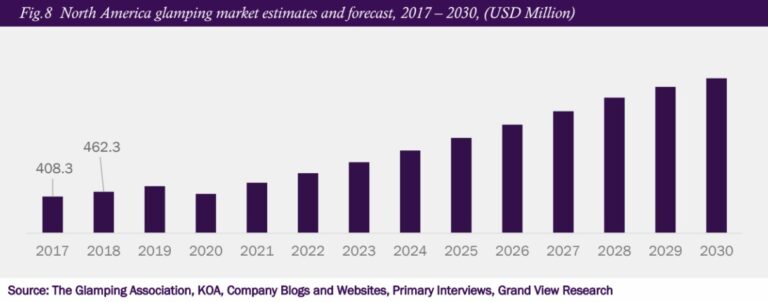

A market research report by Grand View Research shows that the global glamping market size is expected to grow at a compound annual growth rate (CAGR) of 10.9% from 2022 to 2030, after being valued at USD$2.35 billion in 2021. Just this year, it’s expected to hit USD$2.74 billion.

Glamping worldwide: A growing trend

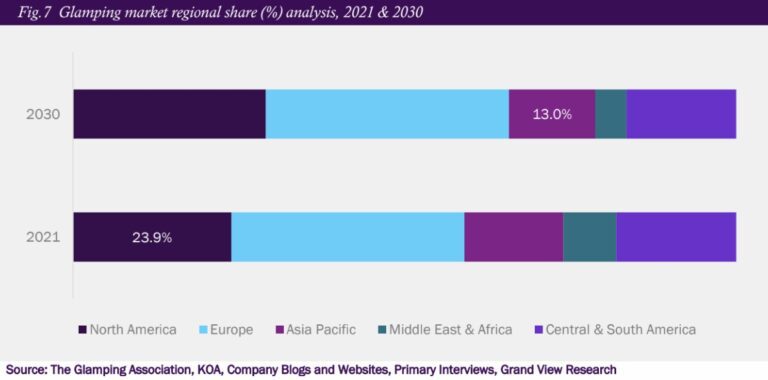

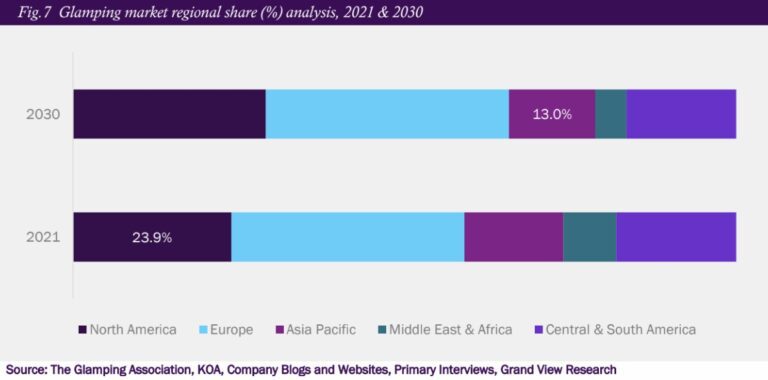

Glamping is growing worldwide, but Europe is still the leading continent in the sector, with 35.11% of the market share in 2021 (Grand View Research).

European operators have diversified the types of accommodation they offer (see more on accommodation types below) and are tapping into the trend for unusual, unexpected guest experiences.

In Europe, as in the US, glamping accommodation that offers easy access to the great outdoors but also provides high-tech amenities and facilities—namely, well-equipped cabins—is most popular, especially among families.

And, exciting growth is afoot in North America over this forecast period too (see below for more on the US and Canada specifically).

Emerging trends

The glamping market is largely dominated by young people (or young families) seeking luxury staycations, and eco-friendly outdoor wellness.

Young people

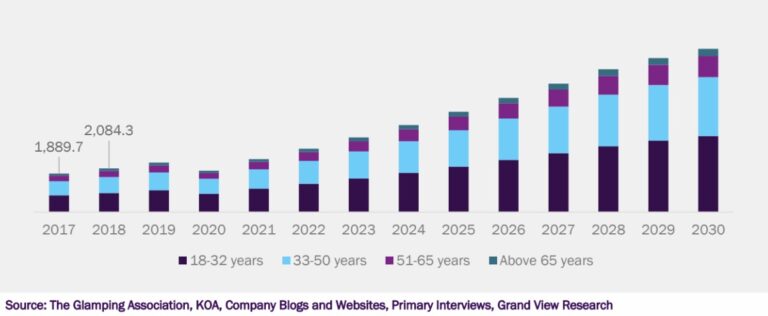

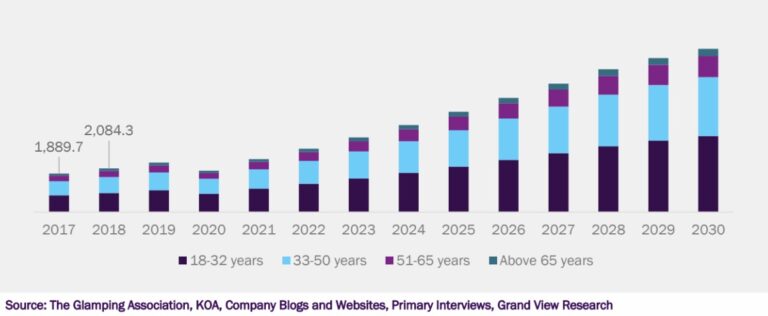

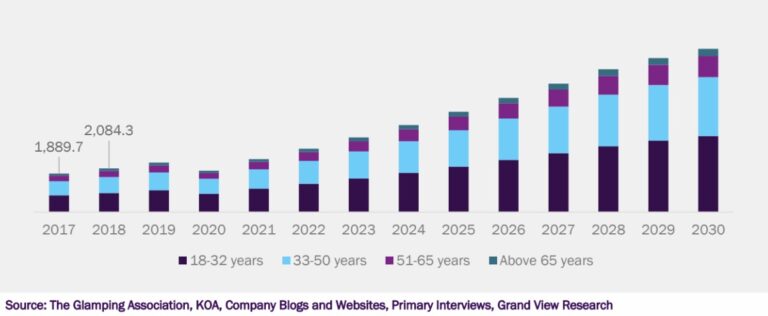

Glamping is especially popular among those aged 18 to 32.

The cozy glamor and outdoor appeal of glamping—and its Instagrammable, TikTok-friendly aesthetics—are increasingly popular on social media, spreading awareness of glamping among this age group (with 64% of Instagram users under age 34, and 45% of TikTok’s global reach aged 18 to 24 (Statusbrew)).

The popularity of destination weddings, which are also most common among those in their 20s and 30s, is also driving the trend, with increasing numbers choosing to book out luxury outdoor glamping spaces to host their special day.

Yet, glamping is popular with the not-quite-so-young, too. Together by age group, the 18-32s and 33-50s hold more than 70% of the market share (Grand View Research).

Splendid isolation

Post-pandemic, travelers still appear to be seeking the joy of socially-distanced breaks away from the bustle of the city, even if only for a few days.

With more people working from home in smaller spaces and for longer hours due to the impact of Covid-19, there has been a “shift towards outdoor accommodation”, and a rise in travelers wanting to escape their everyday lives without venturing too far, or for too long (Arizton).

Busy workers—especially younger, urban professionals—are looking for places they can go to get closer to nature, without the commitment of a long-haul voyage.

The increasing portability and power of smaller digital devices mean that travelers can escape to nature without completely forsaking their hyper-connected lives. In contrast, some are choosing to go off-grid intentionally, and use the outdoor space and remote locations to digitally detox.

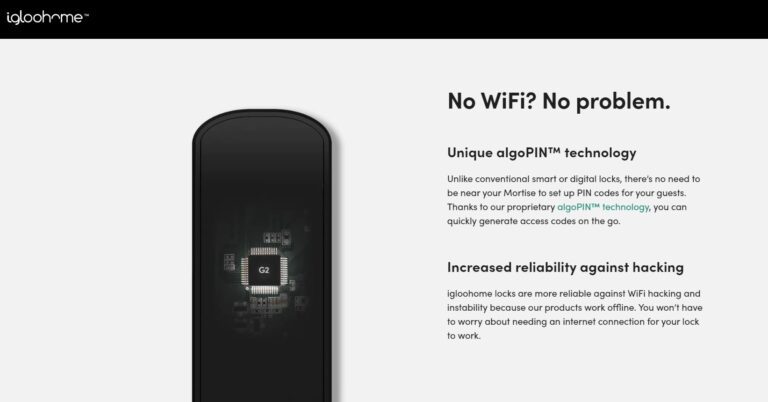

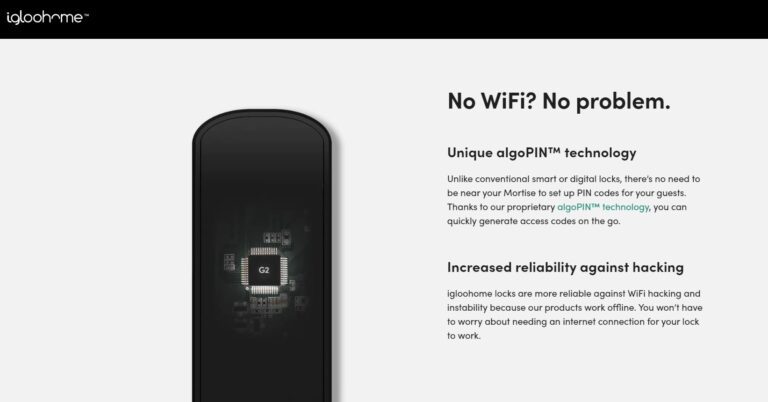

It’s here that smart technology, such as keyless entry for rental properties, comes into its own. It works remotely, doesn’t require anyone to be on-site, and in some cases doesn’t even need Wi-Fi.

Notably, smart locks offer guests keyless access anywhere at any time, whether they’re arriving at a cabin on a pitch-black mountainside, or a tiny in the middle of the woods.

Platforms such as Operto connect to smart locks (such as those by Yale, Salto, or August), and send guests all the check-in details they need ahead of time, automatically, upon booking. This means guests can gain access with just a code whenever they like, even if they have no phone signal at the site.

Rise of music festivals and ‘luxury camping’

The increased popularity of music festivals in recent years has also helped push glamping higher on travelers’ agendas.

Glamping options have become the norm at festivals, offering a compelling upsell offer to traditional camping, and positioning glamping in the public consciousness as the more luxury version of the average tents-and-sleeping bags experience.

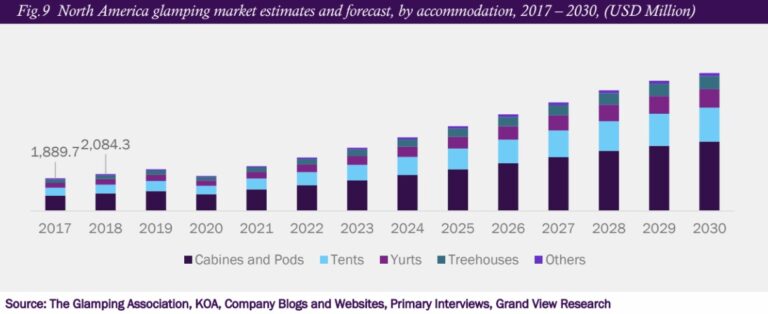

As research by Arizton explains, families and groups seeking a higher level of comfort and/or luxury are particularly taken by options such as cabins and pods. For example, UK-based outdoor accommodation platform, Pitchup.com, has reported a 102% and 73% increase in bookings for cabins and pods respectively since 2018 (Grand View Research). (The growing popularity of cabins and pods can also be seen in North America, see below).

As more permanent structures (as opposed to tents or yurts), these often include facilities such as bathtubs, comfortable beds, electricity, and kitchen space—meaning they can offer convenience without compromising on the sought-after off-beat, outdoor experience.

Sustainability and eco-friendliness

Similarly, increasing awareness of the importance of sustainability, environmental causes, and eco-friendliness is also driving current glamping trends.

Due to their outdoor locations, many glamping accommodations offer eco-friendly plumbing solutions, soaps, and shampoos.

Travelers are increasingly choosing eco-friendly vacations and eco-retreats, and are even more likely to book accommodation providers that can show evidence of green practices.

In fact, the Vacationer Sustainable Travel Survey 2022 found that more than 87% of American adults say sustainable travel is either “somewhat important” or “very important” to them, with 92% of US adults aged 18-29 saying they are likely to make travel decisions based on eco-friendly factors.

The rise of wellness

The explosion of interest in wellness in recent years is also helping to drive the glamping trend, with more travelers seeking out unique experiences close to nature (without, as mentioned above, having to make long-haul trips or disconnect entirely).

For example, growing awareness and popularity of traditions such as “forest bathing” (the Japanese practice of “shinrin-yoku”) or wild water swimming, and their associated benefits, are helping to fuel people’s desire to escape outdoors on their days or weekends off.

Wellness tourism hit US$817 billion in 2020, and is expected to reach $1.3 trillion by 2025, according to studies by the Global Wellness Institute (GWI).

The GWI also shows that 89% of worldwide wellness trips in 2020 were domestic (rising to 95% among US travelers), and that the US was the most popular country overall for wellness travel, taking 19% of the global market in 2020.

As Grand View Research’s report summarizes: “People are looking for restorative vacations that help them feel better, due to rising disposable income among consumers, particularly in developed regions such as North America and Europe, the rising need for getaways as a result of their hectic lifestyle, and the increasing need to unwind in healthy ways for one’s wellbeing.

“This is expected to have a favorable impact on the [glamping] market.”

Glamping market challengesL Pricing, high competition, acessibility

Despite the vast opportunities offered by multiple emerging market trends, challenges still exist.

Picking a price point

Getting your price point right may be a challenge depending on your audience. While some luxury camping can cost up to US$1,000 per night, this may not be realistic for younger demographics with less disposable income, especially those in the younger age range of 18-25.Rising competition

Fierce competition is emerging from key players specializing in the sector, including Under Canvas, Tentrr, Terra Glamping, Collective Retreats, Getaway, and AutoCamp, in the US alone.Vying with vehicles

As we’ve seen, glamping is popular partly due to the back-to-nature experience it offers guests, and the modern conveniences (such as kitchens and comfortable beds) it can bring without compromising access to the outdoors.However, this means that it competes somewhat with other similar offers, such as recreational vehicles. Converted vans, tiny houses on wheels, and even luxury RVs have grown in popularity in recent years (witness the hashtags #vanlife, #vanlifemovement and #tinyhouse, which have 12.5 million, 1 million, and 2.7 million mentions respectively on Instagram).

Recreational vehicles also offer the advantage that many can be packed up and driven to a new location on a whim, giving guests even more flexibility and freedom without sacrificing comfort. As such, these vehicles may offer real competition to fixed accommodations. like lodges, barns, and treehouses.

Accessibility

While part of glamping’s allure is its offbeat nature, responsible and ethical businesses still need to consider concerns such as accessibility in their glamping business plan. Ensuring access for wheelchairs, the blind or deaf, people with autism, and even those with neurodivergent needs such as hypersensitivity to outdoor noises is important for brands that pride themselves on their inclusivity.

This might mean providing ramps or smooth path surfaces, offering guides in Braille or providing descriptive text on your website, and even offering extra touches such as earplugs, white noise machines, or similar.

Glamping market size in the US and Canada

As with the rest of the world, glamping is on the rise in North America, among similar demographics.

The Ariztion report confidently states: “[In the North American region] the younger generation, notably travel aficionados and millennial families, is primarily responsible for the high levels of glamping involvement in North America.”

Go west

From a regional outlook, the west is the most popular for glamping in North America, with the highest share in the US market and the highest number of campsites (Arizton). This has also been helped by an increase in government spending in the region.

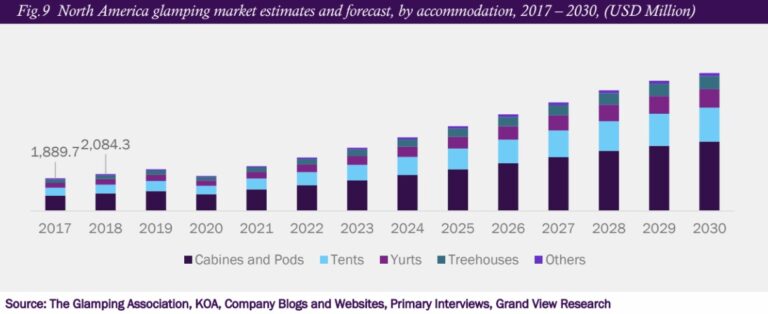

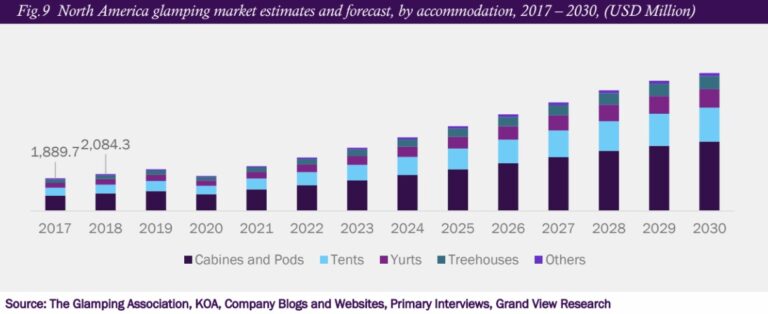

Think cabins and pods

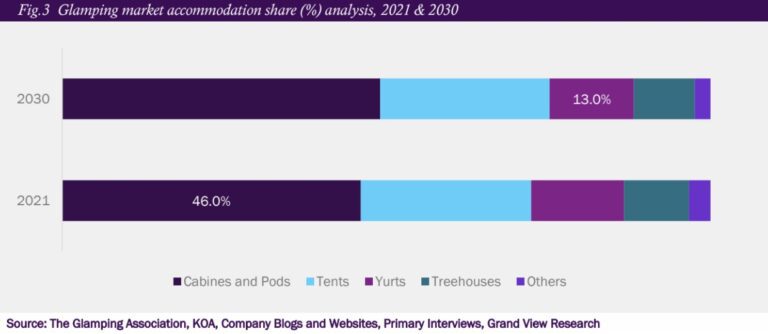

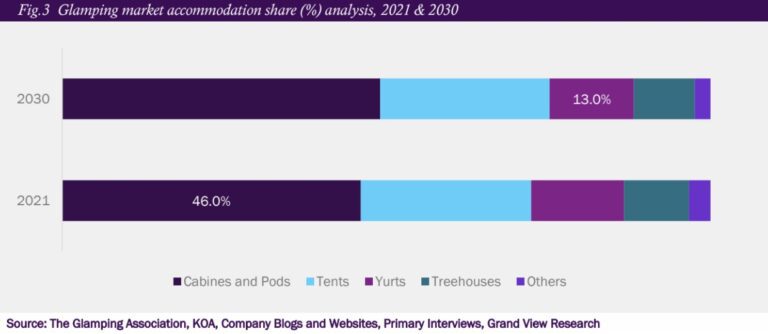

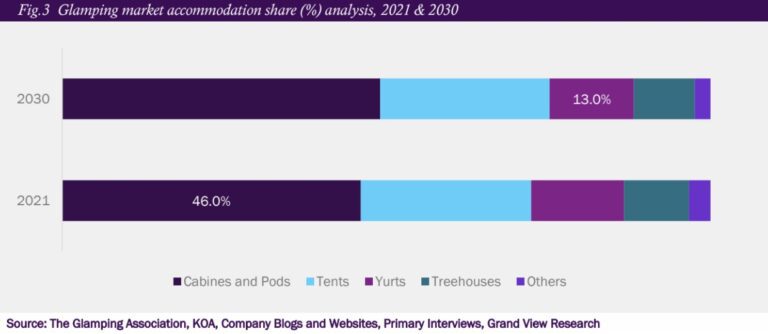

However, as in Europe, cabins and pods are especially popular in North America, with more than 46% share of the market in 2021 (Grand View Research).

This is largely due to their ability to offer more luxurious spaces and amenities, including kitchens, bathrooms, air-conditioning, and Wi-Fi—plus safety features such as lockable windows and doors (particularly popular among families).

In 2021, cabins and pods had the largest market share and highest demand in North America, with a revenue share of 46.03% (Arizton).

Explore the great outdoors

Areas of glamping that are attached to popular local activities or sports tend to perform best.

This includes sites within reach of trails, beaches or national parks, or wine regions where tasting tours are popular. With music festivals playing such a huge role in the popularity of glamping, similar events (for example, food festivals) are also very likely to attract interested guests.

Associating your glamping property to such outdoor activities—in terms of style, amenities, and location—is likely to pay dividends.

A millennial market

As the Arizton report makes clear, younger people are the core glamping demographic in North America.

Generation Z and millennials (around ages 18-35) account for more than 60% of leisure travelers who “glamped” in North America, with Grand View Research adding that those aged 18-32 specifically accounted for more than 44% of revenue in 2021

A study by Kampgrounds of America, Inc. found that 60% of travelers in North America who said they had “glamped” in the past two years were millennials or Generation Z.

However, far from only for those in their 20s or early 30s, travelers aged well into their 40s and early 50s are growing in appetite for glamping. The 33-50s age group is expected to see the second-fastest compound annual growth rate in 2022 and beyond (Grand View Research).

Glamping market growth & trends: Key takeaways

In summary, the glamping market is soaring. Here are some of the main need-to-know industry trends:

- The vast majority of the market is aged 18-35, or at least under 50.

- Glamping sites close to outdoor activities or events perform better.

- Cabins and pods are among the most popular glamping types, along with yurts, tents, and treehouses.

- Getting the price point right, obtaining permissions, and facing up to increasing competition are the main challenges.

Ultimately, the glamping demographic is largely similar to those who favor smart check-in solutions and doing everything on their smartphones (Generation Z and millennial urbanites who want comfort, independence, and near-constant connectivity).

As a result, one of the keys to a successful glamping service includes tapping into the convenience and easy access that smart technology brings, whether you’re offering a relaxed-but-connected staycation site or a digital detox bolthole in the middle of nowhere.

Keep this in mind and you’ll have no issues transferring your vacation rental skills to the great outdoors (and if you’re ready to get started, we’re certain we can help you do just that).

More Articles

Want an operations tool that’s smooth and flexible?

![5 Steps to Scale Your Vacation Rental Business [2024]](https://operto.com/wp-content/uploads/2022/11/shutterstock_1575539170-scaled.jpg)